Content

Total tax revenue under scenario 1 accounts for about 0.7% of total income and revenues in scenario 2 accounts for 1.0% of total income. In Latin America, there are 1.9 million people owning more than $1 million and 105 billionaires. Total tax revenue under scenario 1 accounts for about 1.1% of total income and revenue in scenario 2 accounts for https://quick-bookkeeping.net/ 1.3% of total income. In MENA, there are 915,000 people owning more than $1 million and 75 billionaires. Total tax revenue under scenario 1 accounts for about 0.5% of total income and revenue in scenario 2 accounts for 0.6% of total income. In Russia and Central Asia, there are 230,000 people owning more than $1 million and 133 billionaires.

“It doesn’t self execute as if people just file a sheet of paper and then pay a tax,” Koskinen said. “Knowing how much wealth there is in the country is something of a challenge because we don’t have perfect data on that,” says Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center. But then, there are of course some wealthy Americans who are not nearly as sanguine about this type of tax. As of 2016, the median white family held nearly five times the wealth of the median Hispanic family and more than six times the median black family. Data from the Federal Reserve shows that the top 1% owned nearly one-quarter of all U.S. household wealth 30 years ago…and now owns nearly one-third. Meanwhile, the bottom 50% of people have gone from 3.7% of the wealth in 1989 to 1.9% today.

How would I calculate my wealth tax?

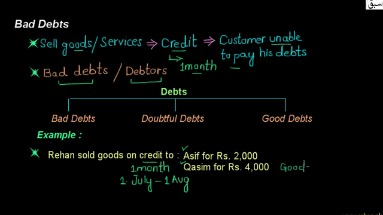

Inheritance taxes are examples of taxes on wealth that are typically assessed once or infrequently. Assets,which you can broadly think of as negatives and positives in a ledger. So, for example, if somebody has $500,000 of assets and $300,000 of debt, that person’s net worth is $200,000. There is a significant conceptual difference between a tax on income and a wealth tax. Taxes on income are levied on funds obtained over a period, generally in exchange for an individual’s time and skill or in the form of interest or dividends. The net worth of a variety of assets held by a taxpayer, such as liquid money, savings in a bank, shares, fixed assets, mopeds, land estate, retirement plans, funds, and housing, are subject to such tax.

- To collect taxes, the federal government relied on voluntary compliance.

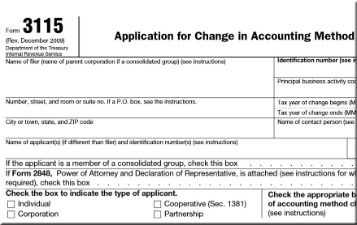

- In order to ensure that the wealthy are not able to evade the tax, the proposal includes a number of key enforcement policies.

- The proposal also stated that non-tradable assets such as real estate would also be subject to an interest rate charge on any taxes deferred on its sale, but not an annual tax.

- Increasing wealth inequality has spurred calls for the adoption of a federal net worth tax in the United States.

- The decline in tax revenues also reflects the fact that a number of countries have either abandoned or scaled back their wealth transfer taxes.

Under Scenario 1, wealth tax revenue accounts for 1.3% of regional income and is close to 1.7% in Scenario 2. In Europe, there are 16 million individuals owning more than $1 million and 499 billionaires. Total revenue under Scenario 1 would be 1.5% of European total income and 1.8% in scenario 2. In North America, there are 29 million people owning more than $1 million and 835 billionaires.

S.510: Sen. Warren’s Wealth Tax

Those responses affect the amount of wealth that taxpayers would report on their tax returns. To reduce their net worth tax liabilities, high-wealth individuals might, for example, hide wealth abroad or increase their spending . The Conservative government’s position on a wealth tax is clear – it isn’t needed. Lucy Frazer, the then-financial secretary to the Treasury, said in 2022 that the UK has “several different taxes on assets and wealth” and “is among the top of the G7 countries for wealth taxes as a percentage of total wealth”.

In order to reduce extreme inequality, we must also establish a tax on the net worth on the top 0.1 percent. The number of OECD countries levying individual net wealth taxes dropped from 12 in 1990 to 4 in 2017 (Figure 1.1). There are many OECD countries that used to have wealth taxes but that repealed them in the 1990s and 2000s including Austria , Denmark , Germany , the Netherlands , Finland, Iceland, Luxembourg and Sweden . In 2008, although it did not technically repeal its wealth tax, Spain introduced a 100% tax credit, reducing all taxpayers’ wealth tax liabilities to zero.

The Bottom Line on Wealth Taxes

Total tax revenue under scenario 1 accounts for about 2.8% of total income and revenue in scenario 2 accounts for 3.5% of total income. In Sub-Saharan Africa, there are 240,000 people owning more than $1 million and 11 billionaires. Total tax revenue under scenario 1 accounts for about 0.3% of total income and revenue in scenario 2 accounts for 0.4% of total income. In South and South-East Asia, there are 850,000 people owning more than $1 million and 260 billionaires.

Senator Wyden also proposed an annual tax on gains and losses of tradable assets owned by billionaires, such as stocks. The proposal also stated that non-tradable assets such as real estate would also be subject to an What Is A Wealth Tax? interest rate charge on any taxes deferred on its sale, but not an annual tax. A wealth tax is imposed on an individual’s net wealth in addition to the other taxes, such as income taxes, that they must pay annually.